CTC (Cost to Company) means the total salary and benefits an employer spends on you in a year, not just your in-hand pay. It includes basic salary, allowances, bonuses, PF, gratuity, and insurance. Understanding CTC vs in-hand salary helps you evaluate job offers and calculate salary hikes accurately.

CTC full form is cost to company.

"Cost to Company" (CTC) also called as total compensation, refers to the total amount that a company would spend on an employee in a year. It includes every possible monetary expenditure that the company would make on behalf of the employee or because of the employee.

It includes basic salary, allowances, variable pay, benefits, professional tax, Tax Deducted at Source (TDS) and other deductions such as training cost or food allowance.

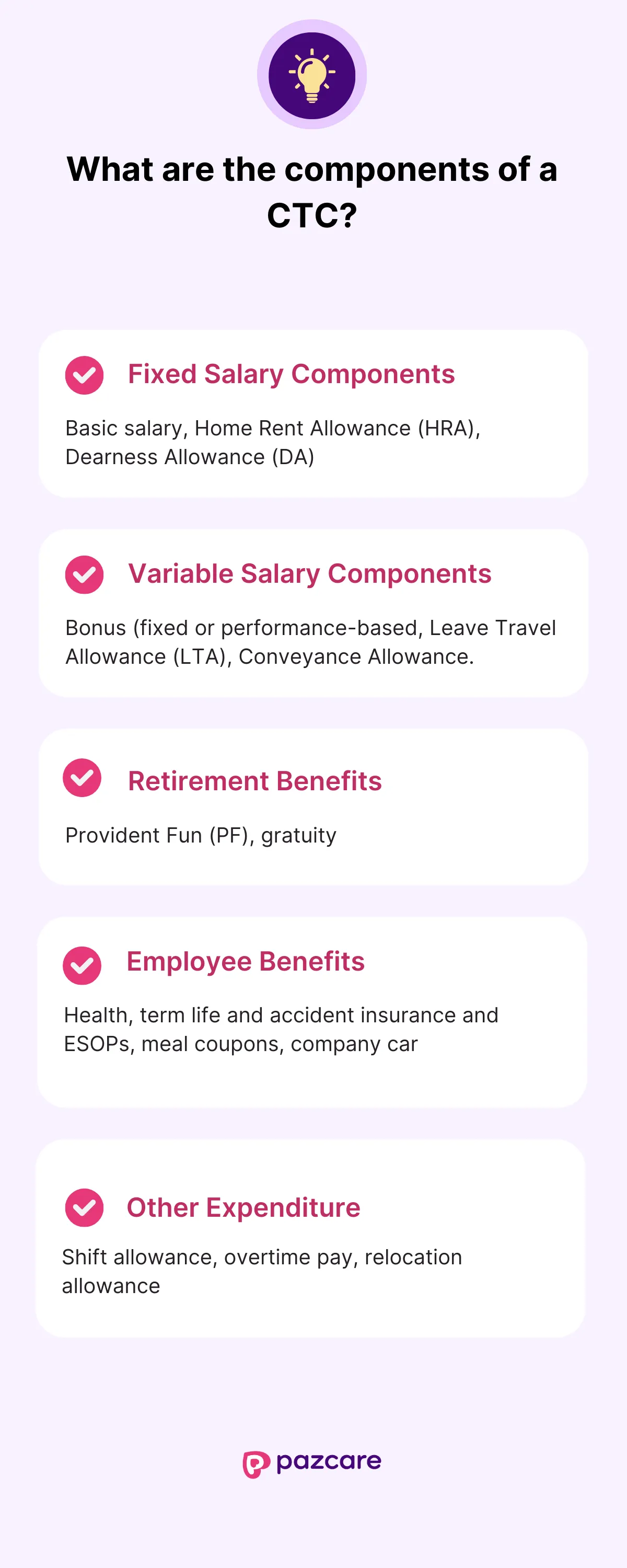

The CTC is a sum of various components. Here are the typical components of CTC:

The core monthly salary. This is the fixed component and the base of other allowances.

An allowance given by the employer to the employee to meet the cost of renting a home.

Paid to cushion the impact of inflation. Not all private companies provide DA.

This can be a fixed annual bonus or a performance-based bonus.

Any additional allowance given to an employee.

Amount given to an employee for travel expenses. In India, LTA is tax-free under certain conditions.

To cover transportation costs that are spent for the company. Example: meeting clients.

Both the employee and the employer contribute to this fund. The employer's contribution is a part of CTC.

Amount paid by the employer when the employee retires or leaves the job after a certain period.

Could be monthly, quarterly, or annually, based on performance targets.

A one-time bonus given when an employee joins a new company.

Group health insurance for employees for which the premium is paid by the employer.

Group accidental coverage in case of accidents for which the premium is paid by the employer

Premium paid by the company for policies like group term life insurance.

For those who require or are given a car for company work.

Like Sodexo coupons or Pazcard that can be used for buying food.

If the company provides them or compensates for them.

For employees pursuing further studies.

Options given to employees to buy company shares at a discounted price.

For employees working in shifts.

For any work over the regular working hours.

Given when an employee is moved to a new city or country.

Like Superannuation benefits.

Each company might have its unique components based on its policies, industry standards, and job roles. When looking at a CTC offered by a company, it's essential to understand each component's breakdown, as not all components will be part of the monthly take-home pay. Some might be annual, some might be savings, and some might be benefits that aren't directly converted to cash.

To understand how changes in salary affect your CTC, use our Salary Hike Calculator to see your updated take-home and total compensation.

Your current CTC refers to the total annual compensation package you are receiving from your present employer, including salary, benefits, and employer-paid contributions.

Recruiters use your current CTC to calculate hikes, negotiate pay, and decide your next salary offer.

Not everything in CTC is paid to you in cash. Some parts go into savings (PF, gratuity), and some are benefits (insurance, food cards).

That’s why CTC vs in-hand salary can look very different.

Every company has different CTC calculations. There will be variation within the company as well.

Let’s understand the common CTC calculation with an example.

Formula: Gross salary + benefits

Gross salary is the total amount of compensation an employee receives before any deductions are made.

It includes basic salary, allowances (HRA, LTA, DA, etc.), bonus, and variable pay.

CTC is the total amount spent by an employer on an employee and it includes gross salary + benefits.

Gross Salary=Basic Salary+Allowances+Benefits

CTC is the total amount spent by the employer whereas take home salary is the amount the employees receive monthly. Take home salary is the net salary after all the deductions (PF, professional tax, TDS etc.) made from the gross salary.

Take-Home Salary = Gross Salary - Deductions.

Notes:

HRs also look for

Free group health insurance consultation

With employee benefits experts to tailor the best policy for your team

Plan employee benefits with our experts

That fit your budget and expectations

CTC (Cost to Company) is the total amount a company spends on an employee in a year. It includes salary, bonuses, employer PF contribution, insurance premiums, gratuity, and other benefits.

CTC in salary means the complete compensation package offered by an employer, not just the monthly pay. It covers fixed pay, variable pay, statutory contributions, and employee benefits.

In a job offer, CTC represents the total value of what you will receive from the employer in one year, including cash salary and benefits.

To calculate a 30% hike on CTC, use this formula:

New CTC = Current CTC × 1.30